Growing wealth

A lot of people would like to be rich. Is there a formula you can copy to get rich?

Boring, useful formulas are typically hard. Not hard to understand, hard to emulate. The weight loss formula is eat cleanly, exercise and sleep 8 hours. Based in intuitive physics that the human body is an engine converting food into energy. Hard to emulate since it requires intentional decision making e.g., stop eating ice cream.

The boring and useful wealth formula is learn compounding, diversify and spend on happiness. It’s hard for the same reasons as weight loss is. Compounding works slowly, till it doesn’t1 and requires being intentional with decisions.

Compounding income is easier than wealth

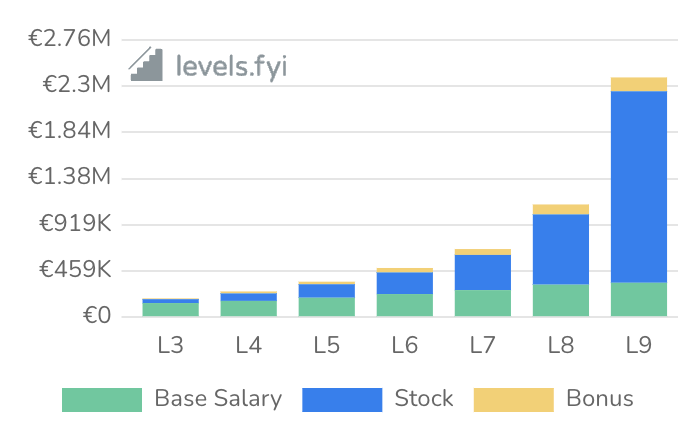

Here’s a graph of current software engineer salaries at Google2. This is not the same person as they grow in their career. An Level 9 engineer today was not earning €186K when they were at Level 3, maybe closer to €~80K.

Here’s a graph of current software engineer salaries at Google2. This is not the same person as they grow in their career. An Level 9 engineer today was not earning €186K when they were at Level 3, maybe closer to €~80K.

Yet, the trend is clear. If one gets promoted every 2-3 years in an engineering job at Google, their annual salary over a 20 year career becomes ~15-20x.

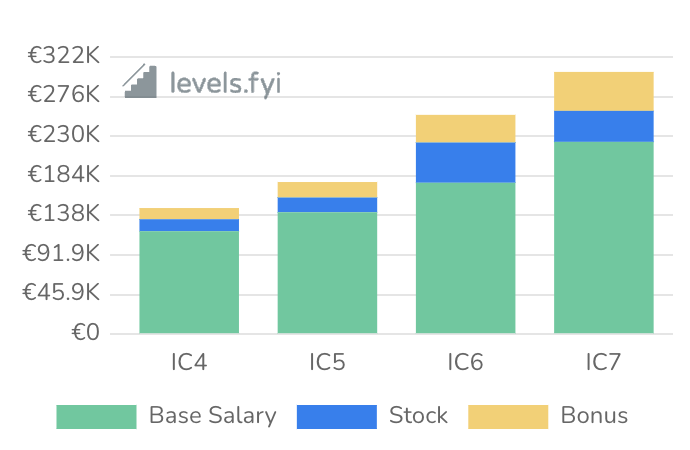

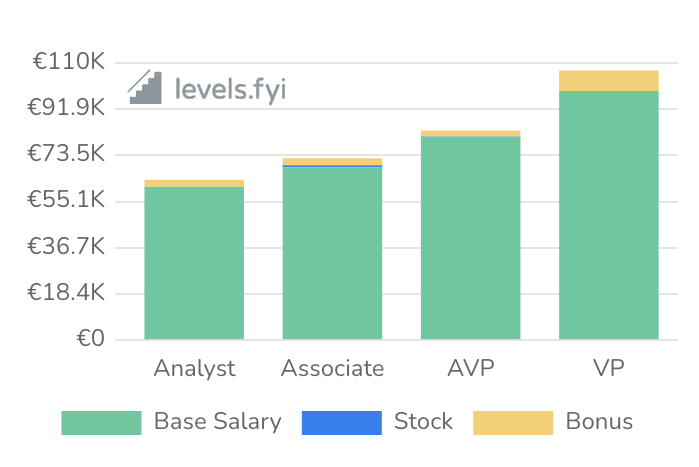

Surely you’re joking, Mr. Singh. This must be true for all companies and all roles. Here’s 2 graphs for comparison.

| HR role at Meta3 (similar company, different role) | Engineering role at Deutsche Bank4 (similar role, different company) |

|---|---|

|  |

Income may limit itself to 2-3x increase over 20 years. So, is the answer finding an engineering job at a technology startup?

No, my argument was to show that incomes compound over a career, not just wealth you accumulate via investing that income. In some roles and in some firms, this annual income compounding may outweigh the returns on wealth for many years. Owning 100% of a company is one of these potential roles. Becoming top 100 in the world in any niche, however small is also such a role.

To predict if a firm, tech or otherwise, will be on a compounding trajectory is hard. Venture capitalists (VCs) professionally in the business of predicting this trajectory rely on a power law5. Only 5-10% of VC investments end up successful and 0.1% have a very high return. Arguably, all had similar starting conditions which is why the VC had invested.

My takeaway after working with a lot of such firms is to work with people you like, solving a problem in the world you care about for an equity stake in the upside. In return, the work is joyful. In my head, there’s just one life, not work-life and life-life to balance between. Becoming the best in what you enjoy is a gift by itself. Having an equity stake ensures you get the financial upside in case your firm is the lucky 10%.

Roger Federer with On shoes and Michael Jordon with Nike Air and owning a franchise emphasize this point on equity.

Finding what will be joyful isn’t hard, just requires doing everything that seems fascinating, once or twice. Like streams flowing over stones. Give yourself the nod to bump against a few stones and accumulate a basket of skills. The likelihood that you’ll love many things is very high. Embrace that.

Actually, I lied. Income grows in step-functions such as promotions or switching jobs / cities or equity contract signing. These events occur irregularly and rarely more than once per year. There’s no obvious compounding. Focusing disproprtionately on these events such as preparing well for an interview6 or negotiating salaries7 or asking experienced hands during equity events8 is the cheat code to income compounding.

Compounding wealth requires diversification

If owning equity stake in your own efforts is the best way to build income, it must follow that owning an equity stake in the world’s smartest, hardworking people lets you build wealth.

Fortunately, we can look at history and demand proof. Here’s a google sheet I created to show what happens if you invested $100 everyday for 20 years in the S&P500. You’d invest ~$500K and be worth more than $1.5M today.

Why the S&P500? The US firms in S&P500 build something useful for Americans and a large part of the world. Consumers pay them for these products and services. Buying small parts of these 500 firms is a future bet that the smart people working there will figure out how to make their users happier by making better and faster things. Most countries with stable populations and economies have this trend.

Why not pick one winner? Nvidia is a stock in the S&P500 which has grown by 3,000x over 20 years. If you can travel back in time, buy Nvidia. It is the home run. However, in 2004, it’s a niche firm making GPUs competing with Intel, AMD, ATI etc. Software behemoths like Microsoft are setting standards like Direct3D which influence the market. Their wins were not certain.

Investing in one stock or one geography has the same flaw. The downside could be huge and unpredictable. In early 2008, with the bursting of the US mortgage bubble, nearly every stock crashed and home prices dipped. However, gold, oil and government bond prices stayed steady.

Creating a basket of investments helps protect against freak events (e.g., covid) which individuals have limited means of predicting. This limits upside potential but we’re discussing formulae for growing wealth, predictably.

ETFs (exchange traded funds) hold a basket of stocks with low annual fee. ETF baskets may hold top firms in US, Europe or China which let users insulate against geography risk such as wars. Owning the house where you live ensures that in case of a layoff, you won’t go homeless. Buying bitcoin may enable you to own the digital currency of the future without worrying about borders. Gold is a scarce commodity that people have traded for centuries before stocks came about.

Without recommending any single instrument, taking diverse bets ensures that the stock of wealth grows reliably.

At a personal level, I will share two recommendations:

- Convert all the bets you’re making into a math equation like the sheet above, and verify if your bets are holding over a 10-15 year period.

- If you find this hard, outsource this decision to portfolio managers who can do this on your behalf and understand tax implications.

It is not a guarantee that the past predicts the future. However, a/ it puts get rich quick schemes into perspective and b/ it helps understand why some parts of the world grow and others don’t9. The wider economic lens to life is useful in contexts outside wealth.

Spending on happiness is compounding

Happiness is being busy doing hard, meaningful things10. It’s neither efficient, nor joyful to run a marathon. Everything hurts and a bicycle or car can get you across the city faster. The same can be said for all passion projects. Woodworking, writing, robots, music, … everything has a cheaper, faster, better alternative.

Family and relationships give life meaning. Doing hard, meaningful things is by definition, time consuming. Time that could’ve been spent compounding income or giving hugs or doing nothing. It’s often equally expensive. The table saw in my Amazon cart judges me as I type this. The act of doing anything is irrational till it isn’t.

Rationality doesn’t explain the Ikea effect11 well. We value things we build with our hands. Skills also easily traverse disciplines and form knowledge graphs. The invention of bitcoin is a testament to someone(?) understanding engineering, history, economics and behavioral science deeply.

Meaningful things compound. The tenth marathon is easier than the first, so is the tenth novel and the tenth concerto. Growing up together with someone makes the wins richer and the losses a bit easier on the heart. I have no personal experience with kids but I do with a pet. Happiness indeed compounds with love.

Life is not zero-sum. While the time spent doing nothing could’ve been spent on something, being bored is how one connects dots across life experiences. That graph of experiences far outweighs any wealth one can accumulate.

Wrapping up the boring formula.

- Learn compounding: You’ll find it in all aspects of life. Slow down at key moments where your income could jump up and force yourself to be intentional.

- Diversity investments: Build wealth by owning equity in multiple domains that generally, do not overlap with each other. Aim for slow growth.

- Spend on happiness: Invest your time with beings that give you joy and build things that you love.

CNBC: 99% of Warren Buffett’s wealth was earned after he turned 65 ↩︎

Scott Kupor’s amazing book on venture capital expands on this idea. Secrets of Sand Hill Road: Venture Capital and How to Get It ↩︎

Amazon’s interview guides cover a range of roles and are the gold standard for preparing well ↩︎

Patrick McKenzie on Salary Negotiation: Make More Money, Be More Valued. ↩︎

VC backed targets receive more stock as the method of payment in mergers and acquisitions than non VC backed targets. JBFA ↩︎

Guns, Germs and Steel by Jared Diamond is a historical perspective on this broad idea. ↩︎

How to be perfectly unhappy by the Oatmeal ↩︎